Executive summary

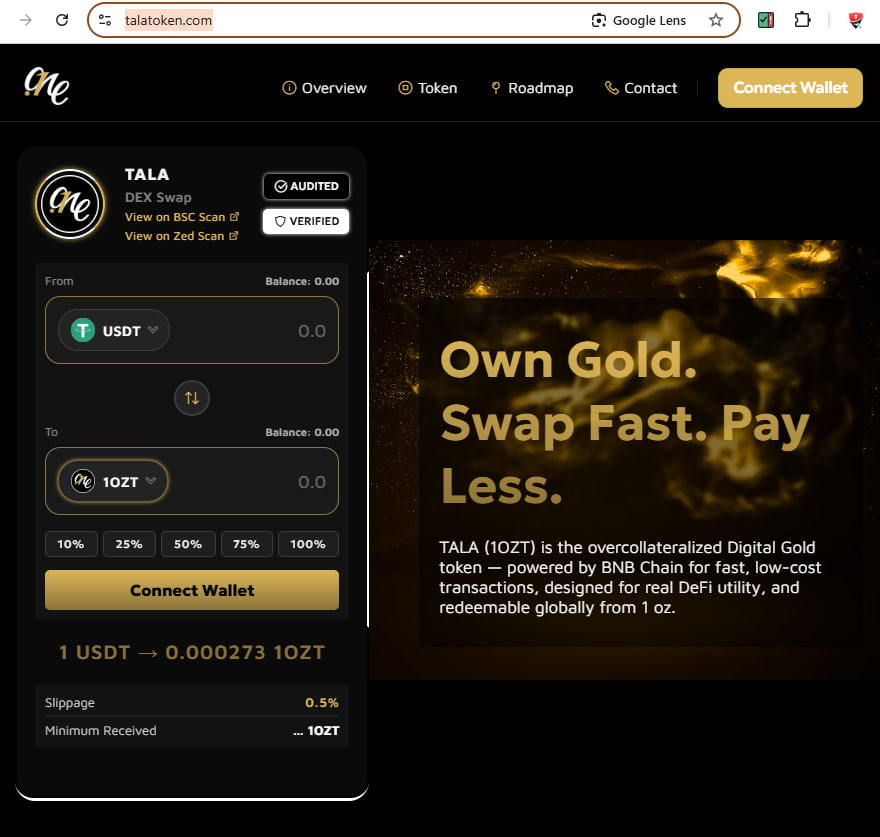

TALA (ticker 1OZT) presents itself as a gold-backed token on Binance Smart Chain. Its whitepaper (Feb 2025) claims each token equals one troy ounce of 999.9 gold, “over-100%” reserves, zero custody costs, 0.002% transfer fee, 2% redemption fee, fixed supply of 3,220,000, and smart-contract audits by CertiK and SlowMist.

After technical, on-chain, and legal review, these claims don’t hold up. There is no verifiable proof of reserves (PoR), no public audit links, no identifiable, registered custodian (the named “Dotone Gold Co.” cannot be verified in independent registries), confusing or multiple contract addresses with negligible liquidity, and no compliance with Iran’s 2024/25 central bank requirements for online gold platforms. In parallel, Babak Zanjani’s public statements about importing large quantities of gold are contradicted by official accounts (a small, non-standard shipment was reportedly returned), which should temper any trust in a “tokenized gold” venture he fronts.

What TALA says it is

- Network / Standard: Binance Smart Chain (BEP-20).

- Peg: 1 token = 1 oz 999.9 gold.

- Reserves: “Backed by more than 100%” and stored in the company’s offices and contracted banks.

- Issuer / Custodian name: “Dotone Gold Co.”

- Costs: zero issuance and storage; 2% to redeem physical bars; 0.002% transfer.

- Security: claims of CertiK and SlowMist audits.

- Liquidity: “high liquidity,” algorithmic market making, and listing plans on reputable exchanges.

If true, TALA would function like PAXG/XAUT: on-chain ownership with off-chain, independently attested bullion. The problem is nothing material is evidenced.

Technical & on-chain reality

1) Contract transparency and liquidity

- Ambiguity in contract address(es): community trackers show more than one “1OZT/TALA” address floating around. For a commodity-backed instrument, a single, verified contract with verified source code, locked mint functions, and disclosed admin keys is a minimum bar.

- Minuscule holder base and liquidity: the DEX pools observed carry near-zero liquidity and very few holders. This directly contradicts the whitepaper’s “high liquidity / market-making” narrative. Low liquidity means the “price” can be painted by tiny trades and does not reflect redeemable value.

Why it matters: A gold-backed token without deep, verifiable liquidity or a robust redemption desk is not a gold surrogate; it’s a thinly traded IOU whose price can be manipulated.

2) “Audited by CertiK/SlowMist”

- The whitepaper names top audit firms but provides no public audit URLs on certik.com or slowmist.com. Reputable projects link directly to the auditor’s portal; anything else is marketing.

Why it matters: “Audit-name-dropping” without a public report is a common confidence trick.

3) Proof of Reserves (PoR): none

- There is no serial-numbered bar list, no custodian account statements, no daily/weekly PoR attestation from an independent accounting firm, no insurance certificates, and no custody agreements published.

- The supposed custodian/producer “Dotone Gold Co.” cannot be independently verified (registrations, directors, addresses, licenses).

Why it matters: Gold-backed tokens live or die on PoR and custodian auditability. Absent that, the peg is purely rhetorical.

Corporate opacity: “Dotone Gold Co.”

TALA’s documents repeatedly rely on a single name—Dotone Gold Co.—as minter, producer of 999.9 bars, and custodian. Independent corporate registries, industry references, and trade databases do not corroborate a legitimate bullion producer or recognized custodian by that name.

Risk implication: This looks like a shell/placeholder label rather than a regulated custodian. Without a regulated vault, clear addresses, and third-party audits, redemption promises are non-credible.

Market/communications optics vs reality

You may see a CoinMarketCap page or “price trackers” on big platforms. Those pages are not exchange listings; they’re information widgets. They often ingest self-reported data and do not validate reserves or legal status. Without listings on tier-1 exchanges (Binance, Coinbase, Kraken) or a regulated OTC/redeemer, the project remains unvetted from a market-infrastructure perspective.

Zanjani’s gold claims and credibility gap

Babak Zanjani has publicly claimed importing “large” quantities of gold (even “tons”). Official statements counter this with a much smaller ~13 kg shipment that reportedly failed standards (sub-1 kg bars, non-compliant fineness) and was returned. The pattern—dramatic claims vs modest, non-compliant reality—directly informs the risk profile of a “Zanjani-backed” gold token. If he could not meet basic bullion import standards, why assume he can run a transparent, audited tokenized-gold program?

Iranian regulatory yardstick—and how TALA violates it

In late 2024/early 2025, the Central Bank of Iran (CBI), with MOIS/Ministry of Industry, Mine & Trade (SAMANEH JAMeE-ye Tejarat), Police Cyber Unit (FATA), and Bank Kargoshaee, set explicit rules for reopening payment gateways of online gold platforms. Key mandatory conditions:

- Real-time bullion custody at Bank Kargoshaee; within three months, holdings must be converted to standard 995+ bars.

- One-to-one reconciliation between users’ in-app balances and the platform’s bank account at a local settlement bank.

- Full trade reporting to the Comprehensive Trade System (Samaneh Jame’e Tejarat) and official approval.

- T+2 (≤ 48 working hours) cash settlement to users—no delays.

- Security clearance from Police FATA; only then can gateways be reactivated.

TALA fails every single item:

- No evidence of custody at Bank Kargoshaee or any Iranian settlement bank.

- No proof of in-app–to-bank reconciliation (it’s a BSC token, not a licensed domestic wallet).

- No registration or reporting in the Comprehensive Trade System.

- No credible redemption desk—so 48-hour cash settlement is a fiction.

- No FATA/CBI approvals or public licenses.

Bottom line in Iran: Even legal online-gold shops lost payment gateways until they met the five conditions. TALA doesn’t meet any—it attempts to circumvent the domestic framework by using a foreign blockchain narrative (“it’s a token, not a domestic gold sale”), while marketing it as gold to Iranians. That’s a regulatory red flag.

How the scheme likely works (plausible mechanics)

- Legitimacy theatre: a whitepaper with comforting words (over-collateralized, audited, zero storage), a fancy website, and a CMC page.

- Liquidity mirage: tiny DEX pools and sporadic trades create a price shadowing the global gold price, suggesting a peg without actually supporting redemptions.

- Audit name-drops: invoke CertiK/SlowMist to disarm skeptics, but never publish links.

- Custody smokescreen: a non-verifiable “Dotone Gold Co.” stands in for real vaults and LBMA-grade logistics.

- Narrative leverage: Zanjani’s media claims about “bringing gold for the people at real prices” repaint regulatory pushback as political obstruction, not compliance failure.

Risk assessment

- Reserve risk: Highest. No PoR, no bar lists, no bank statements, no independent attestations.

- Custody risk: Highest. No verified custodian; issuer-custody in “company offices” is unacceptable.

- Counterparty risk: Extreme. Key promoter has a track record of outsized, disputed claims and unresolved liabilities.

- Market risk: High. Illiquid pools; any “price” can be painted.

- Legal risk (Iran): Severe. Fails the five CBI conditions; potential enforcement, gateway blocks, or criminal exposure for local promoters.

- Operational risk: High. Multiple/unclear contract addresses, no transparent admin policy, no disclosed redemption workflow or SLAs.

What a legitimate gold token must show (checklist)

- Public PoR: independent firm, frequent attestations, serial-numbered bar list, custodian statements.

- Recognized custodian: licensed vault (LBMA/COMEX-recognized), insurance certificates, addresses, and contact.

- Audits with links: auditor portals (e.g., certik.com/project/…), signed PDFs; not screenshots.

- Single verified contract: verified code, immutable supply (or transparently governed), published admin key policy.

- Redemption mechanics: step-by-step KYC, fees, locations, timelines, and a history of completed redemptions.

- Legal compliance: in Iran, explicit CBI/FATA approvals and Bank Kargoshaee custody if targeting Iranian retail.

TALA satisfies none of the above.

Conclusion

TALA Token markets itself as “the safe, modern face of gold.” In practice it is an unverified IOU with marketing gloss: no public audits, no verifiable reserves, a custodian no one can validate, illiquid contracts, and direct conflict with Iran’s gold-platform rules. Coupled with Babak Zanjani’s history of inflated gold claims contradicted by authorities, the project’s risk profile is extreme.

Verdict: Treat TALA as high-risk / likely fraudulent until it delivers bank-level PoR, real audits, a regulated custodian, single verified contract, and full compliance with Iranian law. Anything less is not “digital gold”—it’s a narrative.