1. What is Pump and Dump?

Pump and Dump is a classic financial fraud scheme. Organizers artificially inflate the price of a security or token by spreading hype, misleading claims, or false information (the “pump”), then sell their holdings at the inflated price (the “dump”), leaving latecomers with heavy losses.

Official References

- U.S. Securities and Exchange Commission (SEC):

“Pump-and-dump schemes involve the touting of a company’s stock (or asset) through false or misleading statements to the marketplace. After pumping the stock, fraudsters quickly sell off their holdings, leaving investors with losses.”

Source: SEC – Pump and Dump Schemes - U.S. Commodity Futures Trading Commission (CFTC):

CFTC warns that pump-and-dump operations are widespread in virtual currencies due to low liquidity, making it easy for fraudsters to manipulate prices.

Source: CFTC – Pump-and-Dump Virtual Currency Scams

2. The NOJOB Token Case

Token Details

- Name: NOJOB

- Network: Solana

- Contract Address:

EBnYS6VszyJeTYcs5dpgsH9Mfuryn5rcbyz98ZmKwN3H

Data and Chart Sources

- Birdeye (price chart & trades): Birdeye – NOJOB

- Dexscreener (trading pairs): Dexscreener – NOJOB

- Dextools (pair explorer): Dextools – NOJOB Pair

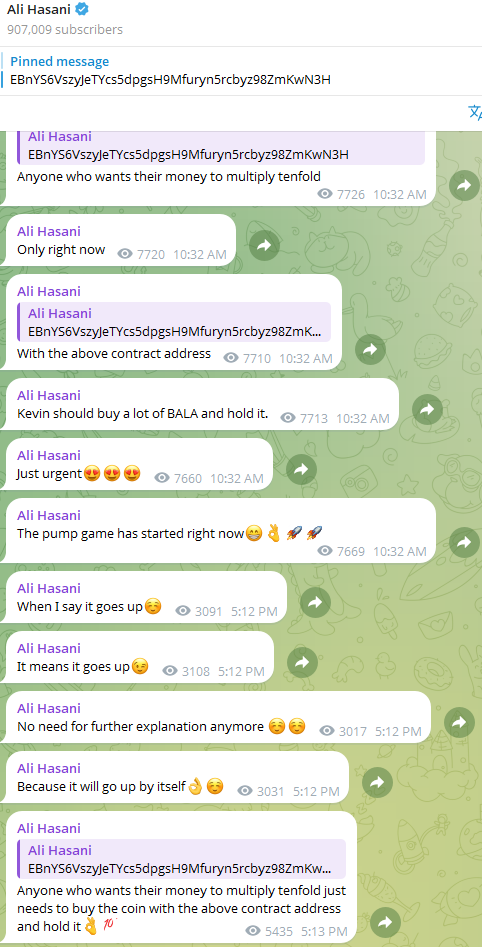

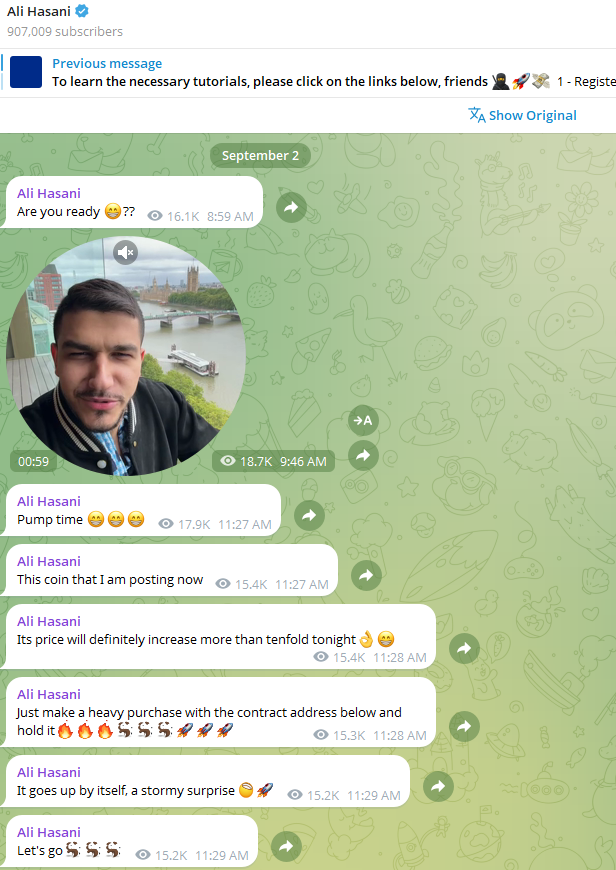

3. Ali Hassani’s Role

First Promotion (September 2, 2025 – around 18:35)

Ali Hassani launched an aggressive campaign in Telegram channels:

- “Pump has started 💣💣💣”

- “200% pure profit already 😍”

- “Buy heavy with the contract address above and hold, price will 10x tonight 🚀”

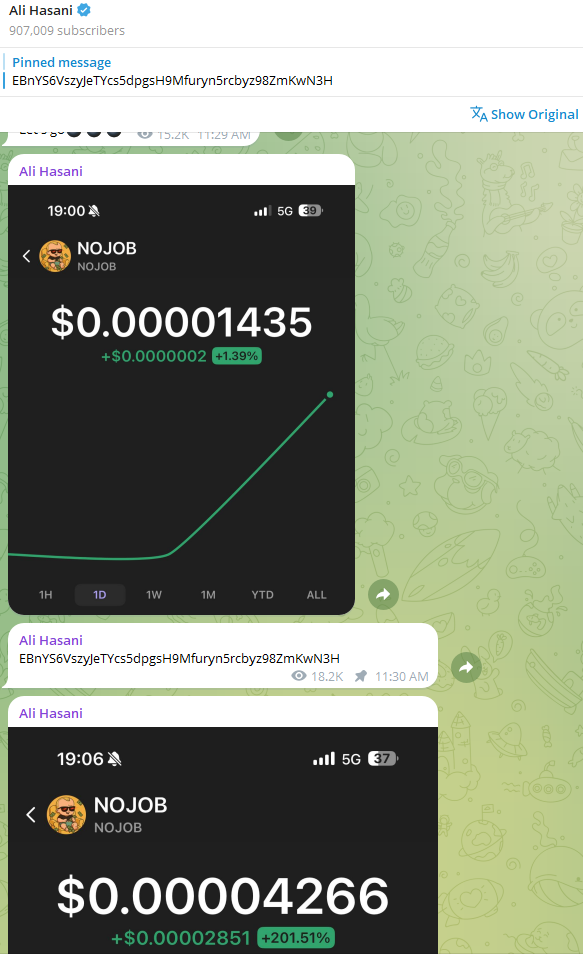

📈 On Birdeye, the token spiked to around $0.14–$0.15. Within less than 24 hours, it collapsed to $0.04 (a 70%+ crash).

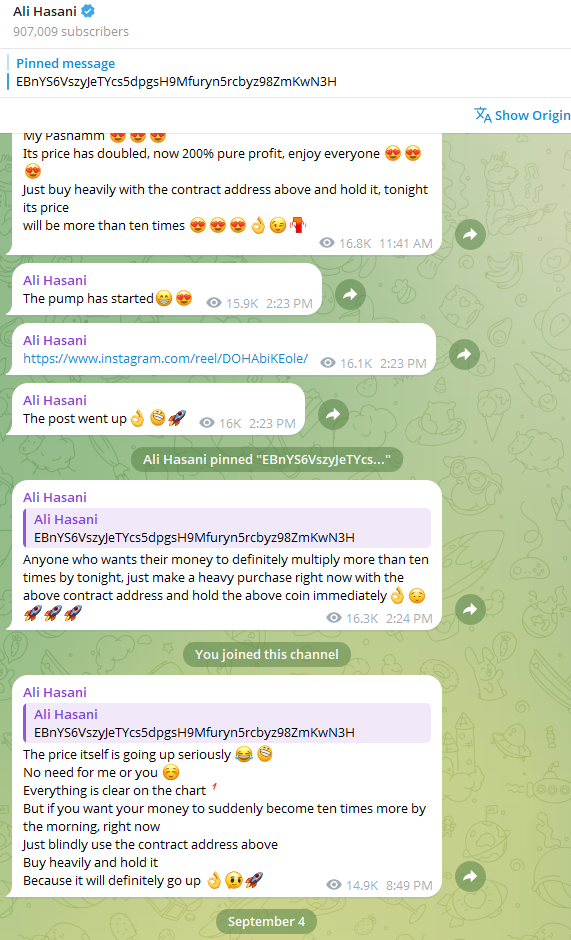

Second Promotion (September 4, 2025 – around 16:26)

After the crash, Hassani pushed the same token again with nearly identical hype:

- “It’s pumping time 😍😍😍”

- “Today is the storm, buy heavy and hold”

- “Pump game starts right now 🚀🚀”

📉 The chart shows a smaller secondary pump, followed again by a sharp dump to around $0.028–$0.03.

This demonstrates that the same worthless contract was used twice within three days to extract money from new victims.

4. Financial Analysis

- Market Cap: ~$123,000

- Liquidity: ~$148,000

- 24h Trading Volume: ~$36,000

- Ownership Concentration: Over 60% of tokens held in a single wallet

Estimated Fraud

- First Pump & Dump: $20,000–$30,000 extracted by the main wallet.

- Second Pump & Dump: Several thousand more withdrawn.

- Total Estimated Exit: $30,000–$40,000, potentially up to $70,000 if the full 60% wallet is sold.

5. Why Do People Still Follow Scammers?

One key reason pump-and-dump schemes keep working is the complicity of some retail investors. Many people know these projects are fraudulent and will eventually collapse, but they still participate, hoping to get in early and sell before the crash. In doing so, they stop being mere victims and become part of the fraud mechanism itself. This behavior enables scammers to continue, since the hope of “beating the system” makes ordinary people fuel and legitimize the scam.

6. Legal Assessment

Under SEC and CFTC definitions, Ali Hassani’s actions clearly qualify as financial fraud:

- Disseminating false and misleading information about guaranteed returns.

- Artificially manipulating price through concentrated token ownership.

- Extracting funds while latecomers suffer heavy losses.

If this conduct had occurred within U.S. jurisdiction, it would fall squarely under securities and commodities fraud enforcement.

7. Conclusion

The NOJOB token case exemplifies how traditional pump-and-dump fraud has migrated into the cryptocurrency space:

- Fraudsters like Ali Hassani exploit hype, fear of missing out (FOMO), and investors’ greed.

- Victims suffer major losses while organizers walk away with tens of thousands of dollars.

- The reuse of the same contract for multiple pump cycles shows just how brazen and exploitative these schemes can be.

This case underscores the urgent need for education, vigilance, and regulatory awareness to protect retail investors in decentralized markets.